If you are a B2B lender or broker, checking basic information on your prospects and customers can help you make better lending decisions, as well as identifying new sales opportunities.

Whereas in the past this important information would have been sourced manually or using a web portal separate from your core business system, with QV Accelerate it is now available at your fingertips, without leaving your workflow.

Our business search functionality gives users the fastest, most accurate company credit validation reports on over 2.5 million active businesses in the UK, along with many more across Ireland.

Business Searches

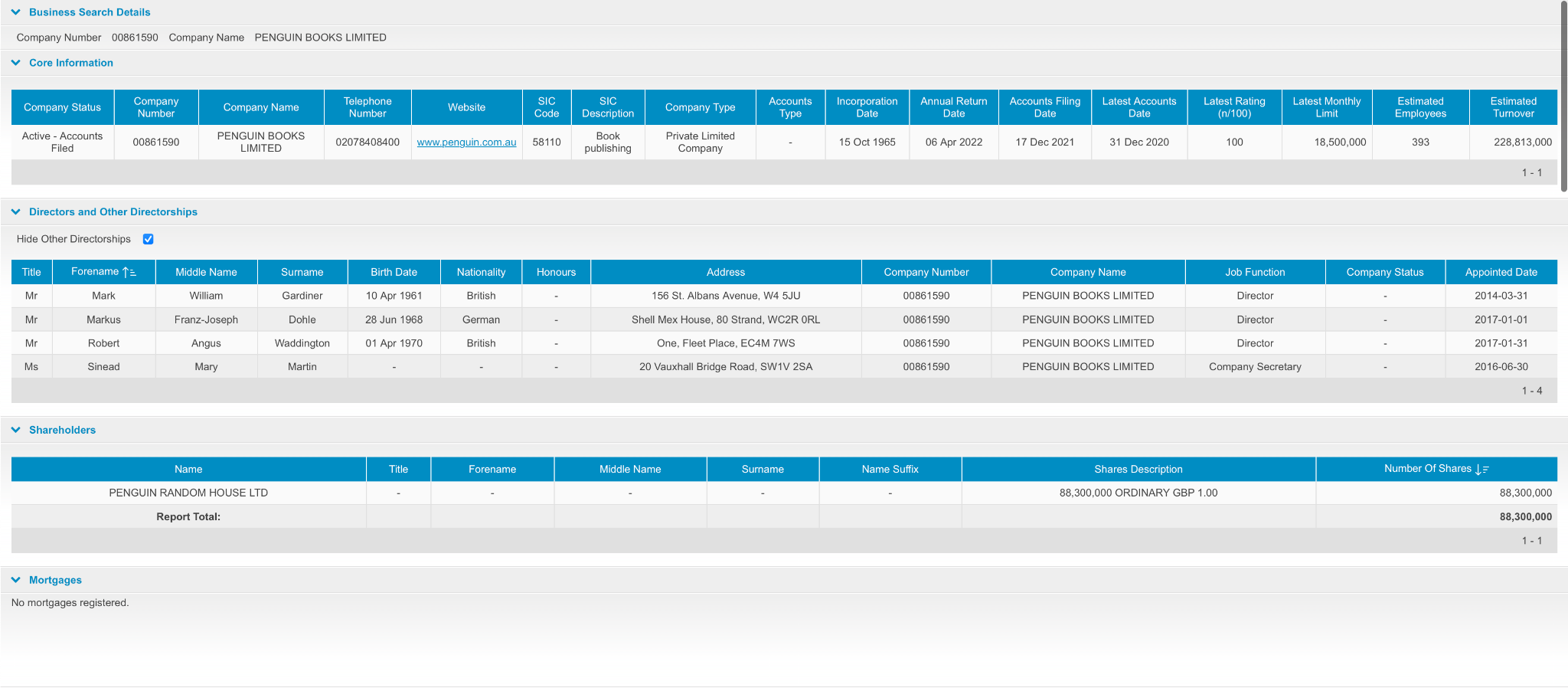

Business Searches is available on any business relationship record in Accelerate - simply click the ‘Add Search’ button to begin. Once you have instigated your search we simultaneously retrieve a complete company profile, with details such as their full address, registered company and address, group structure, SIC Code, turnover, and number of employees. You also see quality, comprehensive, financial reports, comprising the company’s credit rating and limit, P&L details, balance sheet and list of directors.

Once you’ve completed a search you will see a core details section with web address, accounts filing dates, a recommended credit limit, a credit score out of 100, and estimated number of employees. Below that are several areas focusing on key business information:

Directorships and Other Directorships

Directorships and Other Directorships

Shows the details of those controlling the business, and also the other businesses they are involved with

Shareholders

Shows the details of the business owners.

Mortgages

Shows details of any mortgages or other charges against the business.

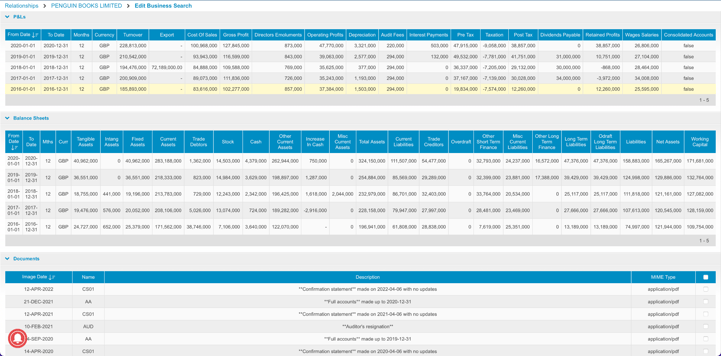

P&Ls

Shows details of the trading performance of the business.

Balance Sheets

Shows details of the assets of the business.

Documents

Lists documents (e.g accounts, incorporation certificates etc.) that you can download and store against the relationship record.

Rating History and Limit History

Shows how the recommended credit limit and credit rating has changed over time, assisting in identifying a direction of travel for the business.

Taken together, this valuable data allows you to make more informed trading decisions, discover new business opportunities, and safeguard your organisation from bad debt, all without leaving Accelerate!

If you’d like to find out more about how business insights can work with your Accelerate platform, get in touch with the QV team today.

Back to blog